Estate Planning

& Legacy Preservation

Comprehensive estate planning and wealth transfer strategies designed to preserve your legacy for future generations. Our sophisticated approach minimizes transfer taxes while ensuring your wealth continues to benefit your family and chosen causes.

Schedule Estate Consultation

Comprehensive Estate Planning Services

Our estate planning services address all aspects of wealth transfer, from basic estate planning to complex multi-generational strategies.

Estate Plan Design

Comprehensive estate plan design tailored to your family structure, wealth level, and philanthropic objectives.

- • Will and testament preparation

- • Power of attorney documents

- • Healthcare directives

- • Beneficiary designations

Trust Strategies

Advanced trust planning including revocable and irrevocable trusts designed to minimize taxes and provide flexibility.

- • Revocable living trusts

- • Irrevocable life insurance trusts

- • Charitable remainder trusts

- • Dynasty trusts

Wealth Transfer

Strategic wealth transfer techniques to move assets to the next generation while minimizing gift and estate taxes.

- • Annual gifting strategies

- • Grantor retained annuity trusts

- • Sales to intentionally defective trusts

- • Family limited partnerships

Business Succession

Comprehensive business succession planning to ensure smooth transition of business ownership while minimizing tax impact.

- • Buy-sell agreements

- • Management succession planning

- • Employee stock ownership plans

- • Recapitalization strategies

Charitable Planning

Strategic charitable giving strategies that support your philanthropic goals while providing significant tax benefits.

- • Private foundation establishment

- • Donor-advised funds

- • Charitable lead trusts

- • Planned giving strategies

International Planning

Cross-border estate planning for clients with international assets or beneficiaries, including treaty planning and compliance.

- • Cross-border estate planning

- • Foreign trust compliance

- • Treaty optimization

- • Pre-immigration planning

Our Estate Planning Philosophy

Family-Centered Approach

Every estate plan is designed around your family's unique dynamics, values, and objectives. We consider not just the financial aspects, but the human elements of wealth transfer.

Flexibility and Control

We design estate plans that provide maximum flexibility while maintaining appropriate control. Your plan should adapt to changing circumstances and family needs.

Multi-Generational Thinking

True estate planning extends beyond the next generation. We help you create structures that can benefit multiple generations while preserving family values.

Estate Planning

A structured, end-to-end process that covers every aspect of wealth transfer. Ensuring assets are protected, optimized, and passed on exactly as intended.

Family Assessment

Comprehensive assessment of your family structure, wealth, and objectives for wealth transfer.

Strategy Design

Development of customized estate planning strategies aligned with your family's goals and values.

Implementation

Systematic implementation of estate planning strategies with coordination among all advisors.

Ongoing Review

Regular review and updates to ensure your estate plan remains current with changing laws and circumstances.

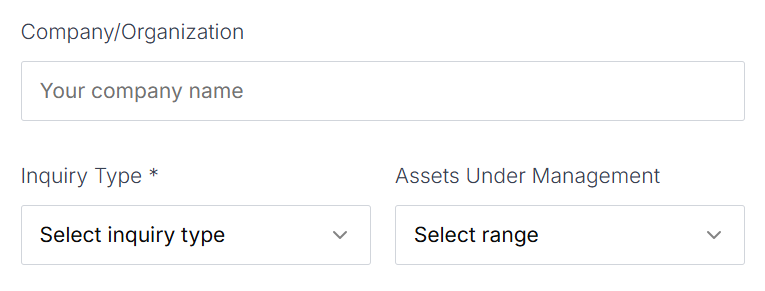

Preserve Your Legacy

Don't leave your family's financial future to chance. Partner with Cavalcade Associates to create a comprehensive estate plan that preserves your wealth and values for generations to come.